Deen Dayal Upadhyaya Swavalamban Yojana is a startup loan scheme being run by the state government of Arunachal Pradesh. Under the Swavalamban Yojana, the state government is providing financial assistance in form of subsidy on startup loan. The objective of the scheme is to encourage unemployed youth to gain to low-cost capital for setting up of entrepreneurship.

Under Deen Dayal Upadhyaya Swavalamban Yojana, the state government will facilitate bank loans to the youths’ between Rs. 10 lakh and Rs. 1 Crore for setting up greenfield enterprises. The candidates can take loan from any bank of the state (Except Arunachal Pradesh Rural Bank (APRB) & Arunachal Pradesh State Co-operative Apex Bank Ltd (Apex) under the scheme.

Apart from 30% subsidy, women entrepreneurs would be eligible for additional 5% subsidy annually provided they don’t turn out to be Non Performing Assets (NPA). To avail the scheme benefits, the beneficiaries need to register with Stand Up India scheme of central government. Under the Swavalamban startup loan scheme, the candidates have to contribute at least 10% of the project cost by themselves.

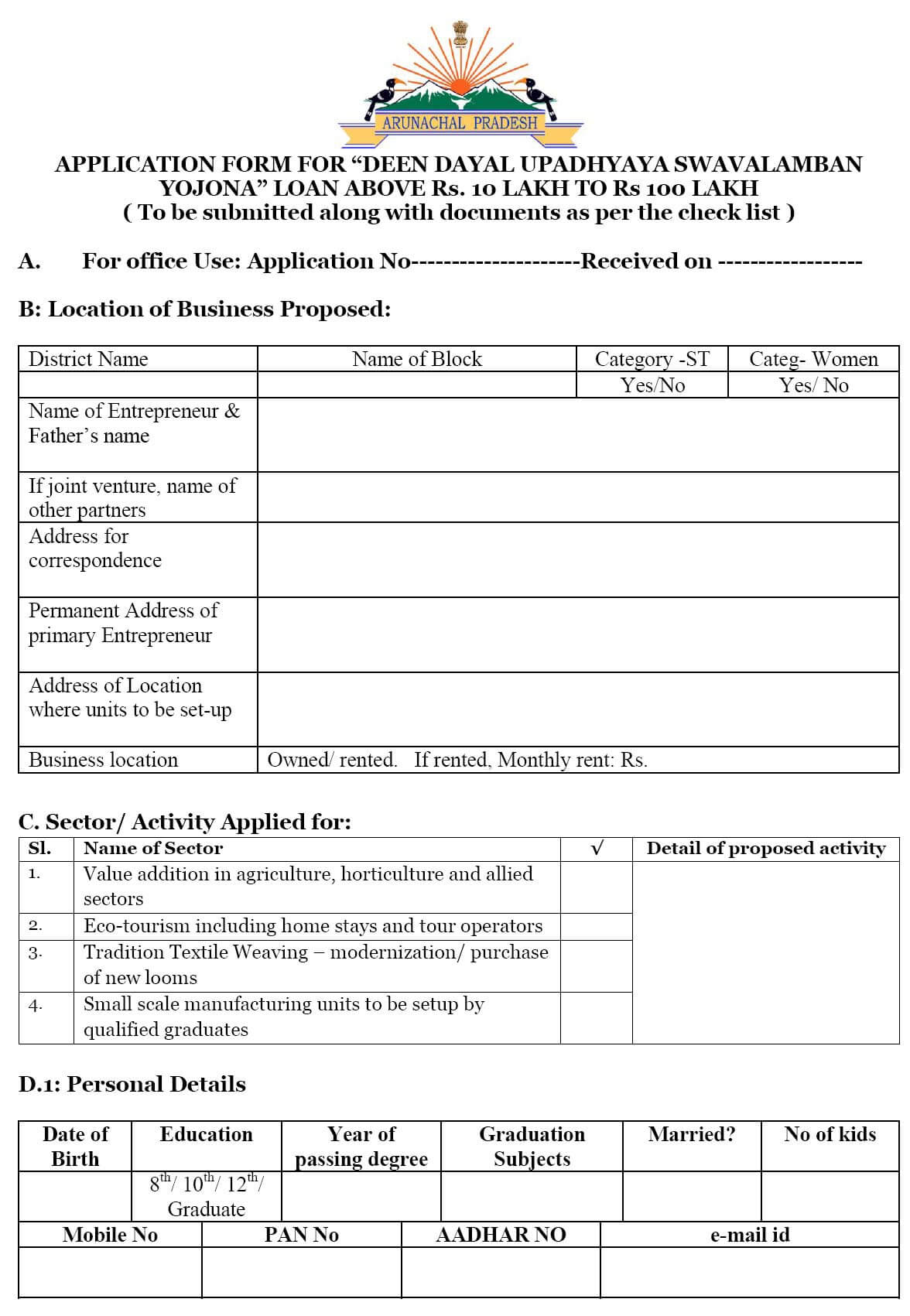

Application Forms for Deen Dayal Upadhyaya Swavalamban Yojana 2024

Deen Dayal Upadhyaya Swavalamban Yojana applications can be made only through the offline mode. Below is the step by step guide on how to fill application forms to avail startup loan subsidy under the Swavalamban Yojana.

STEP 1: Register at Stand Up India Portal https://www.standupmitra.in/

STEP 2: Prepare a DPR on any of the eligible Activities.

STEP 3: Download the application form of DDUSY from the official website at http://itanagar.nic.in/scheme using the direct link given below.

Direct Link – Download Application Form

STEP 4: Fill all the mandatory details in the form and submit application form in the Office of ADC, HQ.

STEP 5: After submitting the form, the candidate will obtain an acknowledgement of receipt from the office of ADC, HQ.

STEP 6: All the received application forms will be submitted to DLSC before 25th of every month.

STEP 7: Appear before District Level Screening Committee as and when called for. The District Level Screening Committee (DLSC) will forward the application form to the State level Screening Committee (SLSC). The SLSC will screen the proposal on every 1st Monday of the month.

STEP 8: Now, after approval from both the committees, the candidate can submit their proposal for loan in any bank of state.

Detailed Project Report Under DDUSY

A detailed project report has to be prepared for applying under the scheme for startup loan. Below is the link to see the minimum requirements for the detailed project report.

Deen Dayal Upadhyaya Swavalamban Yojana Guidelines

Detailed scheme notification and guidelines of DDUSY can be downloaded in PDF format from the link given below.

Highlights of Deen Dayal Upadhyaya Swavalamban Yojana

Below given are the main features and highlights of the DDUSY scheme:-

- The government will provide loan from Rs. 10 lakh upto Rs. 1 crore to set up small and medium enterprises. This amount will not include the cost of land and building.

- The government will provide 30% back-ended capital investment subsidy for enterprises. Women will get additional 5% interest subsidy annually for setting up enterprises provided the loan does not become NPA.

- The candidate has to contribute at least 10% amount of the total cost of the project by himself/herself. The candidates who contribute greater portion will get preference from the government.

- The candidates can take loan from any bank of the state but the approval of SLSC is imperative.

The interested candidates can download the notification PDF and guidelines of DDUSY scheme from the following link.

https://itanagar.nic.in/scheme/deen-dayal-swavalamban-yojana/

Last date of application?

How I apply this loan

Complete procedure to apply for loan under Deen Dayal Upadhyaya Swavalamban Yojana is given in the article, you have to fill all the mandatory details in the form and submit application form in the Office of ADC, HQ along with all required documents

Sudama prasad upadhyay pita swamideen gram TARONI post singhpur tahsil Ajaygrah jiela pannamp Hall Add Badi khermai ward 55 kher mai ward jabalpur mp

Application form COVId 19 Lockdown LOANS application form me Sudamaprasadupadhyay pita swamideen gram TARONI post singhpur tahsil Ajaygrah jiela pannamp HallAdd Badikhermaiward55khermaiwardjabalpur mp LOANS application form COVId 19 Lockdown LOANS application form

Can I apply it still now?