India Post Office Recurring Deposit (RD) Account: People who have some defined amount after a certain period of time can make monthly investment in Recurring Deposit (RD). For recurring deposit account, people will not have to make lump sum payment as in FD but can pay in installments every month. Indian Post Office RD interest rate 2024 is 6.7% p.a and can be calculated using post office recurring deposit calculator / RD Calculator. Post Office RD Account Check Online facility is available and candidates can make RD Account Login / RD Login at www.indiapost.gov.in

Recurring Deposit Account in Indian Post Offices

As per central government norms, Post Office Recurring Deposit Account is of 5 years. For opening of rd account online, people can make minimum initial deposit of Rs. 100 per month and afterwards any amount in multiples of Rs. 10. There is no maximum limit in 5 Years Post Office Recurring Deposit Account (RD). People can Compare All Post Office Schemes before making investment.

People can also compare other Post Office Schemes like National Saving Certificate (NSC), Public Provident Fund (PPF), Kisan Vikas Patra (KVP), Sukanya Samriddhi Yojana (SSY), Post Office Savings Account, Senior Citizen Saving Scheme (SCSS), Time Deposit Account (TD), Monthly income Scheme (MIS). Check nsc vs ppf vs kvp vs ssy vs scss vs td vs mis vs rd vs savings account.

RD Account Opening Online Application Form

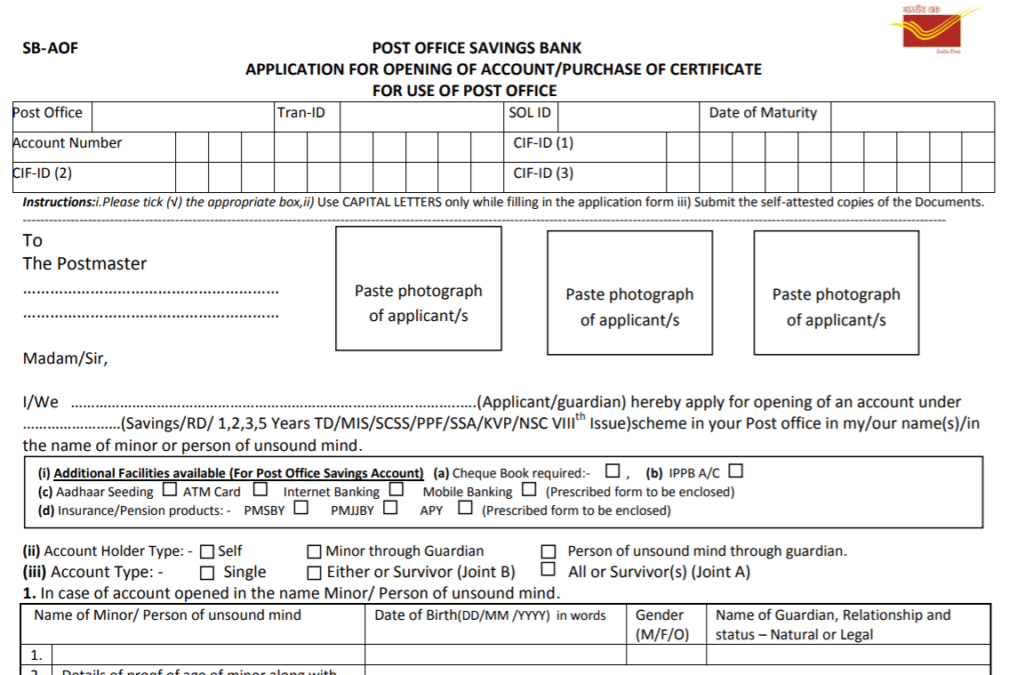

In order to open a Recurring Deposit Account in any post office of India, RD Account Opening Form is to be submitted to the concerned officials. People can now download the India Post Office RD Account Opening Form through the direct link at https://www.indiapost.gov.in/VAS/Pages/Form.aspx#SavingBank. On hitting this link, a new page where RD Account Opening Application Form is present will open. Here click at the “Application Form For Opening Of Account” link, then the Post Office RD Account online application form will appear as shown below:-

Who can open RD Account in Post Offices of India

- A single adult

- Joint Account (up to 3 adults) (Joint A or Joint B)

- A guardian on behalf of minor

- A guardian on behalf of person of unsound mind

- A minor above 10 years in his own name.

Note – Any number of Recurring Deposit accounts can be opened in Post Offices of India.

Deposits in India Post Office Recurring Deposit Account

(i) Account can be opened by cash/cheque and in case of cheque the date of deposit shall be date of clearance of cheque.

(ii) Minimum Amount for monthly deposit is Rs. 100 and above minimum in multiple of Rs. 10.

(iii) Subsequent deposit shall be made up to 15th day of month, if account is opened up to 15th of a calendar month.

(iv) Subsequent deposit shall be made up to last working day of month, if account is opened between 16th day and last working day of a calendar month.

Minimum / Maximum Amount in Post Office RD Account

Minimum INR 100/- per month or any amount in multiples of INR 10/-. No maximum limit.

Recurring Deposit (RD) Account Default

- If subsequent deposit is not made up to the prescribed day for a month, a default is charged for each defaulted month, default @ 1 rupee shall be charged for 100 rupee denomination account (proportionate amount for other denomination) shall be charged.

- If in any RD account, there is monthly default, the depositor has to first pay the defaulted monthly deposit with default fee and then pay the current month deposit.

- After 4 regular defaults, the account becomes discontinued and can be revived within two months from 4th default but if the account is not revived within this period, no further deposit can be made in such account and account became discontinued.

- If there are not more than four defaults in monthly deposits, the account holder may, at his option, extend the maturity period of the account by as many months as the number of defaults and deposit the defaulted installments during the extended period.

India Post Office RD Advance deposit

(i) If an RD account is not discontinued can made advance deposit up to 5 years in an account.

(ii) Rebate on advance deposit of at least 6 installments (inclusive of month of deposit), for Rs. 100 denomination rebate Rs. 10 for 6 month , Rs. 40 for 12 month

(iii) The advance deposit may be made at the time of opening of the account or any time thereafter.

RD Interest Rate 2024

RD Account can be opened in any post office pan India. Candidates can also avail benefits of recurring deposit scheme in banks. Central govt. has permitted RD account opening in various Nationalized banks like SBI, HDFC, Canara bank to ensure higher reach and easy accessibility. Candidates can open this account in cash or through cheque.

RD Interest Rate 2024 is 6.7% per annum (compounded quarterly) with effect from 1 October 2024. The interest earned can be calculated using Post Office RD Calculator. RD Account offers sovereign guarantee, capital protection and quarterly interest payment which acts as source of income. This investment is secure as well as this investment has attractive interests.

Post Office RD Account Check Online – Tax Benefits

In case of Lump Sum Amount, Fixed Deposit (FD) is preferred and in case the person can save a defined amount from income every month, Recurring Deposit (RD) is preferred. Subscribers have the option to withdraw the earned interest or to reinvest it. However TDS @10% is liable to be deducted for both options under 194A of IT Act if the earned interest is more than Rs. 10,000 per annum. Moreover, Income tax on earned interest is calculated as per Income Tax Slab Rates.

Comparison of Tax on Interest – Recurring Deposit vs Fixed Deposit vs Savings Account

| Specification | Fixed Deposit – Tax on Interest | Recurring Deposit – Tax on Interest | Savings Account – Tax on Interest |

|---|---|---|---|

| TDS Applicability | TDS @ 10% of Interest | TDS @ 10% of Interest | No TDS |

| Income Tax Deduction Allowed | Full Interest Taxable | Full Interest Taxable | Rs 10000 Deduction |

| Income Tax on Interest | As per IT Slab Rates | As per IT Slab Rates | As per IT Slab Rates |

Loan on Recurring Deposit (RD) Account

(i) After 12 installments deposited and account is continued for 1 year not discontinued depositor may avail loan facility up to 50% of the balance credit in the account.

(ii) Loan can be repaid in one lump-sum or in equal monthly installments.

(iii) Interest on loan will be applicable as 2% + RD interest rate applicable to the RD account.

(iv) Interest will be calculated from date of withdrawal to date of repayment.

(v) In case loan is not repaid till the maturity, loan plus interest will be deducted from the maturity value of the RD account.

Note:- Loan can be taken by submitting loan application form with passbook at concerned Post Office

Premature Closure of RD Account in Post Office

(i) RD Account can be closed prematurely after 3 years from the date of account opening by submitting prescribed application form at concerned Post Office.

(ii) PO Savings Account interest rate will be applicable if the account is closed prematurely even one day before maturity.

(iii) No premature closure of account shall be permissible until the period for which the advance deposits have been made.

Recurring Deposit (RD) Account Maturity Period

- 5 years (60 monthly deposits) from the date of opening.

- Account can be extended for further 5 years by giving application at concerned Post Office. Interest rate applicable during extension will be the interest rate at which account was originally opened.

- Extended account can be closed any time during the period of extension. For completed years, RD interest rate will be applicable and for period less than a year, PO Savings Account interest rate will be applicable.

- RD account can be retained up to 5 years from the date of maturity without deposit also.

Repayment on the death of account holder

(i) On the death of account holder nominee/claimant can submit claim at concerned Post Office to get the eligible balance of such RD account.

(ii) After sanction of claim, Nominee/legal heirs can continue RD account till maturity by submitting application at the concerned Post Office.

Recurring Deposit Account Interest Rate 2024 is similar to the Interest of FD. But in FD, people have to make lump sum payment, while in RD people can invest in installments. Moreover, FD Interest is paid yearly while RD Interest is paid quarterly. People can also make rd login at website of Post Office RD Account Check Online.

Post Office RD Account Check Online – Highlights at a Glance

All the people who wishes and are able to make monthly investment should invest in this scheme as the initial deposits in fixed deposit account needs to be made as lump sum investment while RD provide the facility to invest in installments. Moreover, people can track their invested amount and make Post Office RD Account Check Online.

The important features and highlights of RD Account – RD Interest Rate, Interest payable, Periodicity, Minimum Opening and Closing balance, Nomination Facility, Transfer of RD Account is given below:-

Recurring Deposit Account – RD Account Calculator and Salient Features

| Interest Payable, Rates, Periodicity – From 1 October 2024, interest rate are as follows – 6.7% p.a (quarterly compounded) |

| Minimum Amount for opening of account and maximum balance that can be retained – Minimum INR 100/- per month or any amount in multiples of INR 10/-. No maximum limit. |

| (a) Who can open:- (i) a single adult (ii) Joint Account (up to 3 adults) (Joint A or Joint B) (iii) a guardian on behalf of minor (iv) a guardian on behalf of person of unsound mind (iv) a minor above 10 years in his own name. Note:- Any number of accounts can be opened. (b) Deposits:- (i) Account can be opened by cash/cheque and in case of cheque the date of deposit shall be date of clearance of cheque. (ii) Minimum Amount for monthly deposit is Rs. 100 and above minimum in multiple of Rs. 10. (iii) Subsequent deposit shall be made up to 15th day of month, if account is opened up to 15th of a calendar month. (iv) Subsequent deposit shall be made up to last working day of month, if account is opened between 16th day and last working day of a calendar month. (c) Default:- (i) If subsequent deposit is not made up to the prescribed day for a month, a default is charged for each defaulted month, default @ 1 rupee shall be charged for 100 rupee denomination account (proportionate amount for other denomination) shall be charged. (ii) If in any RD account, there is monthly default, the depositor has to first pay the defaulted monthly deposit with default fee and then pay the current month deposit. (ii) After 4 regular defaults, the account becomes discontinued and can be revived within two months from 4th default but if the account is not revived within this period, no further deposit can be made in such account and account became discontinued. (iii) If there are not more than four defaults in monthly deposits, the account holder may, at his option, extend the maturity period of the account by as many months as the number of defaults and deposit the defaulted installments during the extended period. (d) Advance deposit:- (i) If an RD account is not discontinued can made advance deposit up to 5 years in an account. (ii) Rebate on advance deposit of at least 6 installments (inclusive of month of deposit), for Rs. 100 denomination rebate Rs. 10 for 6 month, Rs. 40 for 12 month (iii) The advance deposit may be made at the time of opening of the account or any time thereafter. (e) Loan:- (i) After 12 installments deposited and account is continued for 1 year not discontinued depositor may avail loan facility up to 50% of the balance credit in the account. (ii) Loan can be repaid in one lump-sum or in equal monthly installments. (iii) Interest on loan will be applicable as 2% + RD interest rate applicable to the RD account. (iv) Interest will be calculated from date of withdrawal to date of repayment. (v) In case loan is not repaid till the maturity, loan plus interest will be deducted from the maturity value of the RD account. Note:- Loan can be taken by submitting loan application form with passbook at concerned Post Office (f) Premature Closure:- (i) RD Account can be closed prematurely after 3 years from the date of account opening by submitting prescribed application form at concerned Post Office. (ii) PO Savings Account interest rate will be applicable if the account is closed prematurely even one day before maturity. (iii) No premature closure of account shall be permissible until the period for which the advance deposits have been made. (g) Maturity:- (i) 5 years (60 monthly deposits) from the date of opening. (ii) Account can be extended for further 5 years by giving application at concerned Post Office. Interest rate applicable during extension will be the interest rate at which account was originally opened. (iii) Extended account can be closed any time during the period of extension. For completed years, RD interest rate will be applicable and for period less than a year, PO Savings Account interest rate will be applicable. (iv) RD account can be retained up to 5 years from the date of maturity without deposit also. (h)Repayment on the death of account holder :- (i) On the death of account holder nominee/claimant can submit claim at concerned Post Office to get the eligible balance of such RD account. (ii) After sanction of claim, Nominee/legal heirs can continue RD account till maturity by submitting application at the concerned Post Office. Note – Forms available National Savings Recurring Deposit Account Rules |

The above mentioned features make RD Investment more popular for people who wants to save a certain defined money monthly. Furthermore for Post Office RD Account Check Online, visit the official website indiapost.gov.in

References

— For more details, visit the official website indiapost.gov.in

Rd balance check

Ser mera account FPO indian army me dehradun me san Dec 2015 me khola tha..par ab Indian army ke FPO band ho gye hai. To hamara account kha par transfer kiya hoga pta nahi chl rha hai RD puri ho gye hai ….please help me…